Why you should rebalance your portfolio

After a strong market return in 2019 many investors are fearful of increased market volatility. The truth is that no one knows what the stock market is going to do today, tomorrow or at any point in the future. However, we do know that regularly rebalancing your portfolio is a good practice for any investor. Do you regularly rebalance your investment portfolio – including your 401k- back to an established target? Do you know what that target is? Most people that I meet with don’t and it can have a negative effect on your portfolio over the long-term. Read on for an explanation of what rebalancing is and how it is done in practice.

Rebalancing: How It Works

Imagine it’s the first day of your investment experience. As you create your new portfolio, it’s best if you do so according to a personalized plan that prescribes how much weight you want to give to each asset class. So much to stocks, so much to bonds … and so on. Assigning these weights is called asset allocation.

Then time passes. As the markets shift around, your investments stray from their original allocations. That means you’re no longer invested according to plan, even if you’ve done nothing at all; you’re now taking on higher or lower market risks and expected rewards than you originally intended. Unless your plans have changed, your portfolio needs some attention.

This is what rebalancing is for: to shift your assets back to their intended, long-term allocations.

A Rebalancing Illustration

To illustrate, imagine you (or your advisor) has planned for your portfolio to be exposed to the stock and bond markets in a 50/50 mix. If stocks outperform bonds, you end up with too many stocks relative to bonds, until you’re no longer at your intended, balanced blend. To rebalance your portfolio, you can sell some of the now-overweight stocks, and use the proceeds to buy bonds that have become underrepresented, until you’re back at or near your desired mix. Another strategy is to use any new money you are adding to your portfolio anyway, to buy more of whatever is underweight at the time.

Either way, did you catch what just happened? Not only are you keeping your portfolio on track toward your goals, but you’re buying low (underweight holdings) and selling high (overweight holdings). Better yet, the trades are not a matter of random guesswork or emotional reactions. The feat is accomplished according to your carefully crafted, customized plan.

The Rebalancing Take-Home

Rebalancing using evidence-based investment strategies makes a great deal of sense once you understand the basics. It offers objective guidelines and a clear process to help you remain on course toward your personal goals in rocky markets. It ensures you are buying low and selling high along the way. What’s not to like about that?

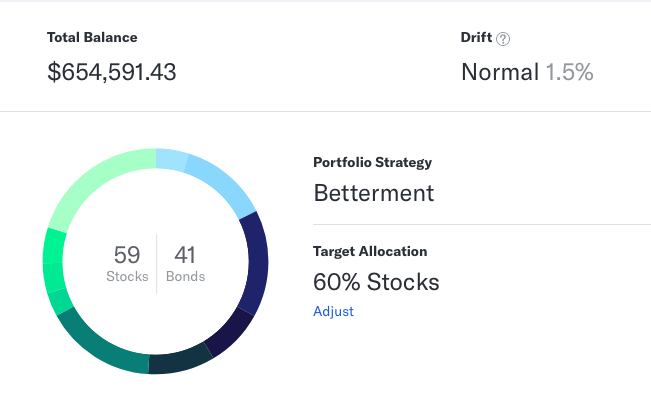

At the same time, rebalancing your globally diversified portfolio requires informed management, to ensure it’s being integrated consistently and cost effectively. An objective advisor also can help prevent your emotions from interfering with your reason as you implement a rebalancing plan. Helping clients periodically employ efficient portfolio rebalancing is another way Yellow Dog Financial seeks to add value to the investment experience. With the advent of new portfolio technology this has become much easier to implement and transaction costs have improved. For some clients, I prefer to use an all digital solution from Betterment which automatically rebalances a portfolio based on several factors.

If you have any questions or would like to talk further about your financial situation, schedule a free consultation here:

Bill Nickles